With ReliableCreditScore, you gain access to a wide network of Providers that fill the gaps of your credit needs that others simply don’t. Once you submit your request, ReliableCreditScore will connect you to one of our trusted Providers with no strings attached. Assess your options and to see if the Provider we found is the right one for you without commitment. If you don’t like your option, simply come back and we will try and find you a Provider that can better assist you with your credit needs. We do not charge you a fee for using our service!

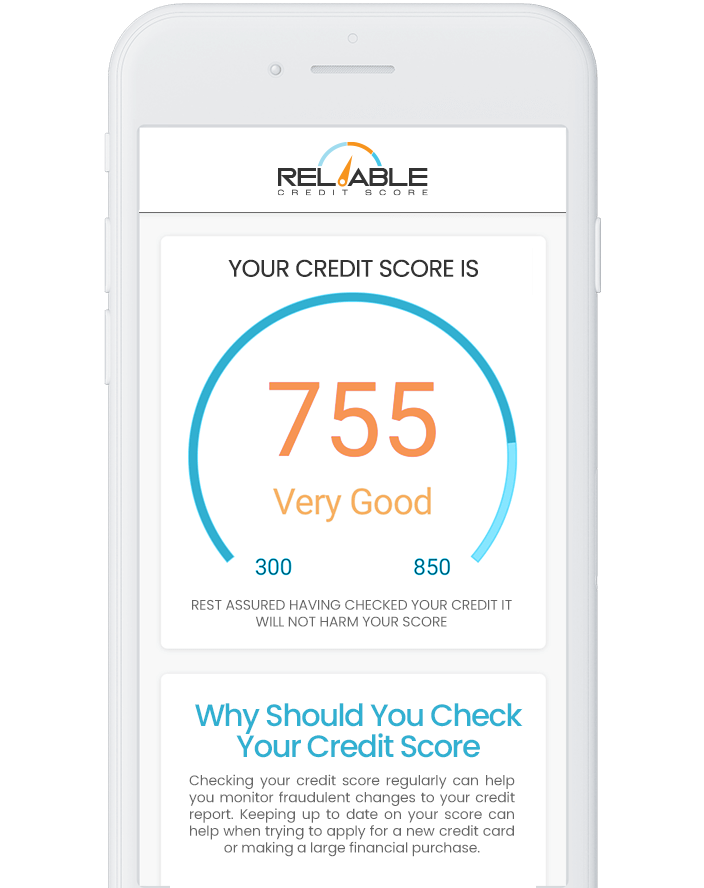

Check your scores as many times as you’d like without impacting your credit. Daily monitoring can alert you to suspicious activity that may pose a threat to your credit.

Navigate your financial future starting with your credit score. Get instant access to your credit scores and gain insight on what is impacting your credit score.

We use industry standard SSL encryption to keep your personal information safe and secure, and to ensure that your data is not intercepted by third parties.

Credit scores play a huge role in your financial life. They help lenders ultimately decide whether you are a good candidate for an extension of credit. This means your credit score could mean the approval or denial of a loan. Your credit score also plays a factor in determining how much interest you will be charged throughout the duration of the loan, which can make your debt more or less expensive for you. Understanding your credit history and tendencies will put you in control of your finances and allow you to make better financial decisions moving forward. Let ReliableCreditScore point you in the right direction!

Credit scoring can be complex and takes into account a number of factors that could impact your overall creditworthiness. Your credit score includes the positive and negative factors affecting your credit. It gives you insight into what you are doing well and offers guidelines on how to improve your credit. With a credit score from one of our Providers, you can track your credit score progress over time and receive customized alerts when changes occur.

A soft inquiry is sometimes referred to as a soft credit check. Soft inquiries can occur for several reasons, including when you check your own credit score, or when a lender runs a credit check to preapprove or prequalify you for a loan. Soft inquiries do not impact your credit score because you are not officially applying for credit. However, once you accept the loan offer and apply, the lender will make a hard inquiry. Because hard inquiries are tied to the actual credit application, it will have an impact on your credit score.

Applying for new credit only accounts for about 10% of a credit score, so the affect is relatively modest. Exactly how much applying for new credit affects your score depends on your overall credit profile and your credit reports. For example, applying for new credit can have a greater effect on your overall credit score if you only have a few accounts open or a short credit history. To understand how opening a new line of credit can affect you, you can always request a “credit inquiry” or “credit check” to check your credit standing.

You can check your credit score as often as you want without hurting your credit. In fact, it’s a great idea to do so regularly and build good habits. At a minimum, it’s a good idea to check your credit score before applying for credit, whether it’s a personal loan, student loan, credit card or something else. By checking a few months in advance of applying for credit, it also gives you time to address anything that could be hurting your score.

Checking your own credit score is considered a soft inquiry and won’t affect your credit. Soft inquiries don’t have an impact on your credit score because you’re not officially applying for credit. So when you fill out a form to get prequalified for a personal loan, student loan, mortgage or credit card, you can be at ease knowing your credit will not be affected.

Credit monitoring is the monitoring of one’s credit history in order to detect any suspicious activity, including credit-related fraud and identity theft. Credit monitoring will not prevent fraud, identity theft, or unauthorized use of your credit. However, the credit monitoring offered by some of our Providers will alert you to important changes, such as credit inquiries, public records, delinquencies, negative information, employment changes, new accounts, and other changes to one’s credit history.

Last Updated: September 18th, 2020

Introduction You are visiting a website owned and operated by FICO Enterprises, LLC. FICO Enterprises, LLC and its subsidiaries (collectively, “FICO Enterprises”, “us”, “we”, or “our”) offers this Website to you conditioned upon your acceptance of all terms, conditions, policies and notices stated herein. These Terms and Conditions (hereafter “Terms”) applies to ReliableCreditScore and all websites owned and operated by FICO Enterprises on which these Terms are displayed (referred here after as Website(s) or Site(s), whether individually or collectively) as well as FICO Enterprises affiliates. This Agreement also applies to your use of any goods, facilities or services offered through the Websites (collectively “Services”), regardless of how they are accessed. By accessing, browsing, or using the Websites, you acknowledge that you understand, accept, and agree to be bound by this Agreement, as well as our Privacy Policy, which is incorporated into this Agreement by reference, You agree that, to the fullest extent required by the law of any state, that you have been provided with, have received, and are agreeing to all disclosure and consent requirements. Certain Services may include additional terms; by agreeing to proceed with any such Services, you acknowledge that you have read, understand, and agree to be bound by any additional terms displayed or referenced that apply to that Service.

Agreement By accessing, browsing, or using the Websites, you acknowledge that you understand, accept, and agree (i) to be bound by this Agreement, as well as our Privacy Policy, which is incorporated into this Agreement by reference; (ii) to the fullest extent required by the law of any state, that you have been provided with, have received, and are agreeing to all disclosure and consent requirements; and (iii) that you are of legal age and not prohibited by law from accessing or using the goods and Services offered herein. Certain Services may include additional terms; by agreeing to proceed with any such Services, you acknowledge that you have read, understand, and agree to be bound by any additional terms displayed or referenced that apply to that Service. If you do not agree to all these Terms, then you may not access this Website or use any of its Services.

Modification We reserve the right, in our sole discretion, to change these Terms at any time by posting revised terms on this Website. The date on which these Terms have been last updated will be noted immediately above this page and the revised Terms will take effect seven (7) days after their publication on this Website. Therefore, you should visit this page periodically to review any changes. Your continued use of this Website after any such changes have been made constitutes acceptance of those changes.

Eligibility The Services on offered on this Website are not available to persons under the age of 18 or to persons who are not legal residents of the United Sates. By using this Website, apply for or using any of its Services, you represent and warrant that you are at least 18 years of age and are a legal resident of the United States. Not all Services are available in all geographic areas. Your eligibility for particular Services is subject to final determination by FICO Enterprises, its affiliates, and or its lending partners.

Authorization to Obtain a Credit Report and Credit Score You understand and agree that by submitting your credit score request, you are providing written instruction under the Fair Credit Reporting Act authorizing us and/or the credit bureaus with whom your request is shared to obtain your consumer credit report, credit score, and/or other information from any consumer reporting agency in order to provide you with quotes and verify your identity. Additionally, you understand and agree that providers may use third party services to obtain information relating to you and to verify any information that you provide including, without limitation your social security number, address, phone number, bank account information and employment history.

Services Offered by this Website

Online Marketplace for Lenders and Other Providers. This Website functions as an online marketplace for you to find third party credit bureaus and other providers that may be of interest to you. By clicking “Submit” or any button indicating acceptance, you are certifying that all of the information you have provided in your request form is true, accurate, and complete. Credit bureaus (hereafter “Network Partners”) that participate in our network may use specific criteria, or filters, to identity the consumers with whom they would like to connect with. The Network Partners also specify the prices they will pay us for the opportunity to present an offer to a consumer that meets the Network Partner’s criteria.

When you submit your credit score request, FICO Enterprises transmits the information you entered in the credit score request form through our network in real time, presenting the information to Network Partners electronically until one Network Partner, often the highest bidding, accepts your credit score request. You will then be directed to that Network Partner’s website where they may present you an offer for a credit score or other products that may be of interest to you. We also may share your contact information with third-party marketers and service providers that may contact you by email or text message/SMS (please note data and messaging rates may apply) to offer you credit scores or other financially related products that may be of interest to you.

We Are Not a Credit Bureau. FICO Enterprises is not a credit bureau, financial institution, or a broker or an agent of a credit bureau, or financial institution. This website collects personal information provided by you and uses that information to connect you to third party credit bureaus or alternative credit bureaus in our network. Your information may be shared with credit bureaus, alternative credit bureaus or other intermediary service providers, to help connect you with a credit bureau.

Advertiser Disclosure. This Website provides its services to you free of charge but may receive payment from credit bureaus and alternative credit bureaus for referring a lead to them. Your use of this Website’s services constitutes your agreement with this compensation arrangement. This Website does not endorse or recommend the services or products of any particular Network Partner. You should rely on your own judgment in deciding which available credit score product, terms, and/or Network Partner most closely fits your needs and financial situation.

Not Professional Advice. FICO Enterprises and the products and services it promotes are not a substitute for professional advice. We provide our Services solely for your convenience, and such Services (i) are not intended as a substitute for professional advice; (ii) should not be construed as the provision of advice or recommendations; and (iii) should not be relied upon as the basis for any financial decision or action. We are not responsible for the accuracy or reliability of any Services. It is your responsibility to evaluate the accuracy, completeness or usefulness of any Services available through this Website. The relationship between you and us is not a professional or similar relationship. We always recommend you seek the advice of a qualified professional with respect to any questions you may have, and to never disregard professional advice or delay in seeking it because of something you have read on this Website.

Data Sharing with Credit Bureaus, Alternative Credit Bureaus, Providers, and Third Parties When you voluntarily submit your credit score request, you understand and agree that we will share the information provided in the credit score request form with credit bureaus, providers, and third parties (also referred to as “Network Partners”). Network Partners may keep the information provided in your credit score request form, and other information provided to us or received by them in the processing of your credit score request, or other products or services that may be of interest to you. Network Partners may retain this information, whether or not you are qualified for the goods or services offered. You agree to notify any particular Network Partner directly if you no longer want to receive communications from them. In addition, FICO Enterprises and its Network Partners may share the information you provide to them with state licensing authorities and government regulators.

Consent to Receive Communications via E-mail, Telephone Calls and/or SMS Messaging When you submit your information on our Website and consent to receive communications from us, please note that we may communicate you via postal mail, e-mail, telephone calls and/or SMS messaging where you have provided your express consent to be contacted through those forms of communication. You may receive these communications directly from us or our e-mail and SMS messaging service providers (hereafter “Marketing Service Providers”) on behalf of us. You agree to receive communications from us and our affiliates electronically and that all agreements, notices, disclosures and other communications (hereafter “Disclosures and Communications”) that we can provide to you electronically satisfy any legal requirement that such communications be in writing.

By submitting your credit score request through this Website, you consent to be contacted by us, our Marketing Service Providers and/or each Network Partner that we transmit your information to, and their affiliates and service providers, by (i) telephone at the numbers you have provided whether landline or cellular, even if your phone number is on any federal, state, or local Do-Not-Call registry and you agree to receive pre-recorded calls and/or messages made with an automatic dialing system; (ii) by email at the email address you provided or at another address that may be associated with you that we receive from other parties and you agree that any such email will not be considered spam or unauthorized by any local, state, or federal law or regulations; and/or (iii) by SMS/text messaging to the mobile number that you provide, in which case data and message rates may apply. Consent is not required in order to purchase goods and services from FICO Enterprises or the Network Partners that reach out to you. By submitting a credit score request through this Website, you understand and agree that you have established a business relationship between you and FICO Enterprises.

If at any time you do not wish to continue to receive communications from FICO Enterprises and its Marketing Service Providers, you may contact FICO Enterprises to opt out (i) through this form; (ii) by sending us an e-mail to info@reliablecreditscore.com, and/or (iii) mail us at FICO Enterprises, LLC. 6545 S. Fort Apache Rd. Suite #135-177, Las Vegas, NV 89148.

Copyrights and Trademark All content within this Website, including without limitation all software, graphics, text, design, images, illustrations, databases, user interfaces, visual interfaces, audio, design, structure, arrangement, products and information (collectively, “Content”) of this Website are owned, controlled, and licensed by FICO Enterprises and/or its licensors. The Content is protected by trademark, copyright, and patent laws, and other intellectual property rights and unfair competition laws. Except as expressly stated herein, no part of the Websites or Content may be copied, reproduced, republished, uploaded, posted, publicly displayed, encoded, transmitted or distributed in any way, including the use of framing or mirrors, to any other computer, server, website or other medium for publication.

Privacy We respect your privacy and use generally accepted industry standards to safeguard your personally identifiable information. For additional information regarding this Website’s collection and use of your personally identifiable information in connection with your use of this Website, please see our Privacy Policy. FICO Enterprises and/or its Network Partners may obtain, verify, and record information including, but not limited to, your name, social security number, address, telephone number and date of birth, that will allow them to properly identify you.

Foreign Users FICO Enterprises makes no representation that materials in this Website are appropriate or available for use in other locations. If you access this Website from outside the United States, please understand that this Website may contain references and/or links to products and services that are not available or are prohibited in your jurisdiction. Any user who is a resident of a foreign country agrees that (i) they have voluntary sought and established contact with FICO Enterprises; (ii) they will not use, transmit, disseminate or upload any material, content, that would violate any applicable local, state or national laws or regulations of the foreign member’s country of resident; (iii) under no circumstance shall FICO Enterprises be deemed liable under any laws other than the United States; (iv) his or her participation is governed by United States law and subject to the arbitration and venue provisions stated herein; and (v) consent to having their data processed in the United States.

Representations and Warranties You represent and warrant to FICO Enterprises that (i) you are at least 18 years of age; (ii) you are authorized to enter into this agreement; (iii) you will not use this Website or the Contents herein for any purpose or manner that violates any laws, regulation or that infringes the rights of us or any third party; (iv) any information or data you provide to us will not violate any law, regulation or infringe the rights of any third party; (v) all information that you provide to us in connection with this Website (e.g. name, e-mail address, phone number and/or other information) is true, correct and accurate; and (vi) you are authorized and able to fulfill and perform the obligations and meet the conditions of a user as specified herein.

Disclaimers and Liability THIS WEBSITE DOES NOT WARRANT, GUARANTEE OR MAKE REPRESENTATIONS REGARDING YOUR USE, OR THE ULTIMATE OUTCOME OF YOUR USE OF THIS WEBSITE, IN TERMS OF AVAILABILITY, ACCURACY, RELIABILITY, COMPLETENESS, INTENDED PURPOSE, QUALITY, FUNCTIONALITY, OR OTHERWISE. THIS WEBSITE AND MATERIALS CONTAINED HEREIN ARE PROVIDED TO YOU “AS IS” AND “AS AVAILABLE” WITHOUT ANY WARRANTIES OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF MERCHANTIBILITY, TITLE, NONINFRINGEMENT, FITNESS FOR A PARTICULAR PURPOSE, AND ANY WARRANTY OUT OF COURSE OF DEALING, USAGE OR TRADE. FICO Enterprises IS NOT RESPONSIBLE OR LIABLE FOR ANY NETWORK PARTNER’S ACTS OR OMISSIONS INCLUDING FOR ANY QUOTES OR SERVICES THAT ANY SUCH NETWORK PARTNER MAY PROVIDE, FOR ANY NETWORK PARTNER’S CONTACTING OR FAILURE THEREOF TO CONTACT YOU, FOR ANY NETWORK PARTNER’S PERFORMANCE OR FAILURE TO PERFORM ANY SERVICES, OR FOR ANY AGREEMENT OR TRANSACTION BETWEEN YOU AND ANY NETWORK PARTNER.

YOU AGREE THAT FICO Enterprises, ITS MARKETING SERVICE PROVIDERS, AND NETWORK PARTNERS WILL NOT BE LIABLE FOR ANY INDIRECT, INCIDENTAL, CONSEQUENTIAL, SPECIAL, EXEMPLARY OR PUNITIVE DAMAGES, INCLUDING, WITHOUT LIMITATION, DAMAGES FOR LOSS OF PROFITS, USE, LOSS OF DATA, LOSS OF SECURITY ARISING OUT OF OR IN ANY WAY CONNECTED TO YOUR USE OF THIS WEBSITE, OR OF INFORMATION OR MATERIALS AVAILABLE THROUGH THE WEBSITE, WHETHER BASED IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE, EVEN IF FICO Enterprises HAS BEEN ADVISED OF THE POSSIBILITY OF DAMAGES. IN PARTICULAR AND WITHOUT LIMITATION, TOTAL LIABILITY OF FICO Enterprises FOR ANY REASON WHATSOEVER RELATED TO YOUR USE OF THIS WEBSITE, RESULTS FROM USE OF THIS WEBSITE, OR FOR ANY CLAIMS RELATING TO THIS AGREEMENT SHALL NOT EXCEED ONE HUNDRED DOLLARS ($100.00 USD). THE FOREGOING LIMITATIONS SHALL APPLY NOTWITHSTANDING ANY FAILURE OF ESSENTIAL PURPOSE OF ANY LIMITED REMEDY. SOME JURISDICTIONS DO NOT ALLOW THE EXCLUSION OF CERTAIN WARRANTIES OR THE LIMITATION OR EXCLUSION OF LIABILITY FOR INCIDENTAL OR CONSEQUENTIAL DAMAGES. ACCORDINGLY, OUR LIABILITY IN SUCH JURISDICTION SHALL BE LIMITED TO THE MAXIMUM EXTENT PERMITTED BY LAW.

Idemnity As a condition of use of this Website and/or FICO Enterprises’ services, you agree to indemnify FICO Enterprises and its Marketing Service Providers, and Network Partners from and against any and all liabilities, expenses (including attorney’s fees) and damages arising out of claims resulting from your use of this Website, including without limitation any claims alleging facts that if true would constitute a breach by you of these Terms. You must not settle any such claim or matter without the prior written consent of FICO Enterprises. The FICO Enterprises parties reserve the right, at their own expense, to assume the exclusive defense and control of any matter subject to indemnification by you, and you further agree that you will cooperate fully in the defense of any such claim.

Errors and Delays You agree that FICO Enterprises is not responsible for any errors or delays in responding to a request or referral form caused by, including but not limited to, an incorrect email address or other information provided by you or other technical problems beyond our reasonable control.

Links to Third Party Websites This Website may contain links to websites maintained by third parties. Such links are provided for your convenience and reference only. We do not operate or control in any respect any information, software, products or services available on non-affiliated third-party websites. Our inclusion of a link to a website does not imply any endorsement of the services or the website, its contents, or its sponsoring organization. Your use of any such third-party websites may be subject to other terms and conditions imposed by the third parties maintaining those websites. When you leave this Website, you agree that we are not responsible for the accuracy or content of the information provided by that website, nor is it liable for any direct or indirect technical or system issues arising out of your access to or use of third-party technologies or programs available through that website.

Notice to Claim For all disputes you may have, whether pursued in court or arbitration, you must first give FICO Enterprises an opportunity to resolve the dispute by providing written notification to info@reliablecreditscore.com and via postal mail to FICO Enterprises, LLC. 6545 S. Fort Apache Rd. Suite #135-177, Las Vegas, NV 89148 stating (i) your name, (ii) your address, (iii) a written description of your claim, and (iv) a description of the specific relief you seek. If FICO Enterprises does not resolve the dispute within 30 days after it receives your notification, you may pursue your dispute as set forth above.

Release and Discharge YOU HEREBY RELEASE, REMISE AND FOREVER DISCHARGE FICO Enterprises, ITS MARKETING SERVICE PROVIDERS AND ITS NETWORK PARTNERS, AND EACH OF THEIR RESPECTIVE AGENTS, DIRECTORS, OFFICERS, EMPLOYEES, INFORMATION PROVIDERS, SERVICE PROVIDERS, SUPPLIERS, LICENSORS AND LICENSEES, AND ALL OTHER RELATED, ASSOCIATED, OR CONNECTED PERSONS FROM ANY AND ALL MANNER OF RIGHTS, CLAIMS, COMPLAINTS, DEMANDS, CAUSES OF ACTION, PROCEEDINGS, LIABILITIES, OBLIGATIONS, LEGAL FEES, COSTS, AND DISBURSEMENT OF ANY NATURE AND KIND WHATSOEVER AND HOWSOEVER ARISING, WHETHER KNOWN OR UNKNKOWN, WHICH NOW OR HEREAFTER EXIST, WHICH ARISE FROM, RELATE TO, OR ARE CONNECTED WITH YOUR USE OF THIS WEBSITE.

Dispute Resolution and Binding Arbitration YOU AGREE THAT ANY DISPUTE BETWEEN YOU AND US, INCLUDING WITHOUT LIMITATION DISPUTES RELATING TO THIS WEBSITE, CONTENT OR SERVICE (“DISPUTE”), SHALL BE FINAL AND EXCLUSIVELY RESOLVED BY BINDING INDIVIDUAL ARBITRATION ADMINISTERED BY THE AMERICAN ARBITRATION ASSOCIATION (“AAA”) IN ACCORDANCE WITH ITS CONSUMER ARBITRATION RULES. DISPUTES WILL BE ARBITRATED AT A HEARING CONDUCTED IN LOS ANGELES, CALIFORNIA; THE ARBITRATOR(S) SHALL HAVE NO AUTHORITY TO DEVIATE FROM THE LAW, AND THE ARBITRATOR(S) SHALL MAKE ALL REASONABLE EFFORTS TO EXPEDITE THE ARBITRATION PROCEEDINGS AND TO LIMIT DISCOVERY. THIS MEANS THAT YOU WILL NOT BE ABLE TO LITIGATE ANY SUCH DISPUTE IN COURT, AND THAT YOU AGREE TO WAIVE YOUR RIGHT TO A JURY TRIAL. YOU AGREE THAT ANY AND ALL DISPUTES WILL BE GOVERNED BY THE LAWS OF THE STATE OF CALIFORNIA WITHOUT REGARD TO ANY CONFLICT OF LAW PROVISIONS. IF ANY MATTER PROCEEDS IN COURT, INCLUDING POST-ARBITRATION CONFIRMATION PROCEEDINGS, YOU AGREE TO THE EXCLUSIVE PERSONAL JURISDICTION BY, AND VENUE IN, THE STATE AND FEDERAL COURTS LOCATED IN LOS ANGELES COUNTY, CALIFORNIA, AND WAIVE ANY OBJECTION TO SUCH JURISDICTION OR VENUE.

You agree that no arbitration under this agreement shall be joined to an arbitration involving any other party subject to this agreement. Arbitration must be on an individual basis. You may not join or consolidate claims in arbitration or litigate in court or arbitrate any claims as a representative or member of a class or in a privacy attorney general capacity. You also agree that any dispute or disagreement regarding the enforceability, applicability or interpretation of any provision of this agreement, including the provisions regarding dispute resolution and arbitration, is a Dispute subject to the arbitration provisions herein and shall be resolved by an arbitrator.

You also agree that any dispute or cause of action arising out of or related to this Website, Services or Content must be commenced within one year from the later of (i) when the dispute or cause of action accrues, or (ii) through the exercise of reasonable diligence you should have known about the accrual of the cause of action. Otherwise, such cause of action is permanently barred.

This Agreement (including all referenced or incorporated policies, agreements and other provisions) constitutes the entire agreement between you and FICO Enterprises and supersedes all prior or contemporaneous oral or written agreements or other communications between the parties with respect to the subject matter thereof. If a conflict between the language of these Terms and the language of any terms incorporated by reference, the latter incorporated terms shall control.

You acknowledge and agree that, in entering into this Agreement, you are not relying on any representation, warranty, statement or promise, express or implied, not explicitly set forth in this Agreement, and you hereby waive any claimed reliance on same. If any provision of this Agreement shall be found to be invalid or enforceable, you agree such provision shall, to the maximum extent feasible, be modified by to render it enforceable with respect to the Dispute at issue and to reflect to the maximum extent possible the intent of the existing language of the provision when considered in the context of this Agreement as a whole, that such modified provision shall be enforced with respect to the underlying claims in the Dispute at issue, and that such a finding of invalidity or unenforceability shall not affect the validity or enforceability of this Agreement as a whole or of any other provision of this Agreement.

No Class Actions To the extent allowed by law, you and FICO Enterprises each agree to waive any right to pursue disputes on a consolidated or class-wide basis; that is, to either join a claim with the claim of any other person or entity, or assert a claim in a representative capacity on behalf of anyone else in any lawsuit, arbitration, or other proceeding. You hereby understand that by agreeing to this class action waiver, you may only bring claims against FICO Enterprises in an individual capacity and not as a plaintiff or class member in any purported class action or representative proceeding.

DMCA Notice Pursuant to the Digital Millennium Copyright Act (DMCA) Safe Harbor 17 U.S.C. § 512(c), if you believe that anything on this Website or service offered herein infringes any copyright that you own or control, you may file notice of such infringement, in compliance with the requirements of 17 U.S.C. 512(c)(3), with our designated agent at FICO Enterprises, LLC. 6545 S. Fort Apache Rd. Suite #135-177, Las Vegas, NV 89148 or info@reliablecreditscore.com. A copy of this legal notice may be sent to a third-party that may publish and/or annotate it. As such, your letter, with your personal information redacted, may be forwarded to the Chilling Effects Clearinghouse for publication.

California Consumer Notice Under California Civil Code Section 1789.3, California website users are entitled to know that they may file grievances and complaints with the Complaint Assistance Unit of the Division of Consumer Services of the California Department of Consumer Affairs, in writing at 400 R Street, Suite 1080, Sacramento, CA 95814, by telephone at (916) 445-1254 or (800) 952-5210, or by e-mail at dca@dca.ca.gov.

Entire Agreement These Terms and FICO Enterprises’ Privacy Policy, which is hereby incorporated by reference as if set forth fully herein, represent the entire agreement between you and FICO Enterprises with respect to subject matter herein, and they supersede all prior or contemporaneous communications and proposals, whether electronic, oral, or written between you and FICO Enterprises with respect to the Website.

Miscellaneous The headings contained in this Agreement are for convenience of reference only, are not to be considered a part of this Agreement, and shall not limit or otherwise affect in any way the meaning or interpretation of this Agreement. If you have questions, comments, concerns or feedback regarding this Agreement or our Services, please contact us at info@reliablecreditscore.com.

Last Updated: September 18th, 2020

Introduction You are visiting a website owned and operated by FICO Enterprises, LLC. FICO Enterprises, LLC and its subsidiaries (collectively, “FICO Enterprises”, “us”, “we”, or “our”) are committed to maintaining your confidence and trust as it relates to the privacy and usage of your information. Please read the following information carefully as it details how we collect, protect, share, and use your information. This Privacy Policy applies to ReliableCreditScore and all websites owned and operated by FICO Enterprises on which this Privacy Policy is displayed (referred here after as Website(s) or Site(s), whether individually or collectively) as well as FICO Enterprises affiliates.

This Agreement also applies to your use of any goods, facilities or services offered through the Websites (collectively “Services”), regardless of how they are accessed. If you do not agree with our Privacy Policy and practices regarding how FICO Enterprises handles your personal information, you should not use our Website. Accessing or using this Website signifies and confirms your acceptance of the terms set forth in this Privacy Policy. This Privacy Policy may change from time to time in our sole discretion. Accordingly, you should visit this Website and review the Privacy Policy periodically to determine if any changes have been made. The date on which this Privacy Policy was last updated will be noted immediately above this Privacy Policy.

Information We Collect

Personally Identifiable Information. In the course of using this Website, we collect information that could identify you such as your name, email address, mailing address, phone number, social security number, driver’s license number, bank information, employment history, information related to your income, and credit.

Other Information. We also collect other information that is not used to identify you, including, but not limited to, browser type, internet protocol (IP) address, device type, date and time stamp of visit, demographic data, and data about your online activity. We use cookies or similar technology to collect such information for advertising and other purposes.

How We Collect Information

Information Provided by You. We collect personal information that you voluntarily provide when you enter it or otherwise provide it in connection with an inquiry into our Services. This information could be provided via an online phone, over the phone, electronic communication, or via other means in which you interact with our Services.

Information from Service Providers. Information may be collected from third-party service providers, such as credit bureaus and service providers who may have data on your financial profile, home, or other demographic information.

Information from Cookies and Other Tracking Technologies. We use cookies, web beacons, and similar technologies to record your preferences, track the use of our Website and collect information. This information may include IP addresses, browser type, internet service provider (ISP), referring pages, operating system, date and time stamp of visit, and/or click data.

How We Use Your Information We use the information that we collect about you through your interaction with this Website as well as information that you voluntarily provide to us. We may use collected information to (i) deliver the products and services you requested, (ii) personalize your user experience; (iii) communicate with you about products or services that may be of interest to you; (iv) to communicate with you via mail, email, telephone, text message/SMS, or otherwise even if your number appears on a do-not-call list or other similar registry; (v) to provide to third-party credit bureaus, alternative credit bureaus or financial institutions for the purpose of determining eligibility for specific products (vi) for business purposes, such as analytics, research, advertising and marketing, and operational purposes; (vii) improve our Website; (viii) improve customer service; (ix) to comply with law enforcement and maintain the security of our Website; and (x) to perform any other functions otherwise disclosed when you provide us with your information.

How Do We Share Your Information

Consent to Receive Communication. By voluntarily providing and submitting your information on our credit score form or otherwise using our website, you opt-in to receive communications (i) from us; (ii) one of our third-party credit bureaus, alternative credit bureaus that we partner with; and (iii) third parties that provide services on our behalf, such as website hosting partners, text message/SMS service providers, email marketing service providers, or other parties who assist us in operating our Website, conducting our business, or serving our users.

Consent to Share Your Information. In submitting an inquiry or using the services provided through our Website, you agree that FICO Enterprises may share your information about you or provided by you with credit bureaus, alternative credit bureaus and other third parties which provide services to our users (collectively, Network Partners”) to deliver the products and services you requested. These Network Partners include third-party credit bureaus, alternative credit bureaus or financial institutions, or intermediary service providers that we partner with to help connect you with a credit bureaus, alternative credit bureaus or financial institution in their network.

Other Situations We Share Your Information. We may also be required to share your information (i) pursuant to a subpoena, court order, legal process, and/or government or regulatory request, (ii) when we believe disclosure is appropriate in order to investigate, prevent, or take action regarding actual or suspected illegal activity or other wrongdoing, to protect and defend the rights, property, or safety of our Business, our users, or our employees, or to enforce our Website’s terms and conditions or other agreements of policies; (iii) as part of a sale, merger or acquisition, or other transfer of all or part of our assets including as part of a bankruptcy proceeding; (vi) with third parties that is not personally identifying, such as aggregated or anonymized data, in our discretion, where not prohibited by law.

Advertising and Analytics We may partner with advertiser networks and other advertiser service providers (collectively, “Advertising Providers”) that serve ads on our behalf and others on non-affiliated platforms. Some of those ads may be personalized, meaning that they are intended to be relevant to you based on information Advertising Providers collect about your use of our website and other sites or apps over time, including information about relationships among different browsers and devices.

We may also work with third parties that collect information about your use of our website and other websites over time for non-advertising purposes. We use Google Analytics and other third-party services to improve the performance of the Website and for analytics and marketing purposes.

How We Protect Your Information By accessing and navigating through this Website, you hereby acknowledge and agree that FICO Enterprises may retain your information indefinitely. Please note that any transmission of personal information is at your own risk.

Our Commitment to Online Security. We use generally accepted industry standards to protect the security of your personal information and encrypt sensitive. Although we strive to provide accepted industry standard security measures for your personal information that we process and maintain, we cannot guarantee the security of your personal information transmitted to and through this Website.

No Liability for Acts of Third Parties. We will exercise all reasonable efforts to safeguard the confidentiality of your personal information. However, transmissions protected by generally accepted industry standard security technology and implemented by human beings cannot be made absolutely secure. Consequently, FICO Enterprises shall not be liable for unauthorized disclosure of personal information due to no fault of FICO Enterprises including, but not limited to, errors in transmission and unauthorized acts of third parties.

Third-Party Links This Website may contain links to third-party websites, which may have independent privacy policies that differ from our own. We are not responsible, nor do we endorse, any of the activities and practices that take place on third-party websites. Accordingly, we recommend that you review the privacy policy posted on any third-party website thoroughly before disclosing any personal information.

Consent to Communicate When you submit your personal information on this Website, you are providing your express consent to be contacted via email, telephone, postal mail or text message/SMS communication. If you wish to opt-out from us sharing your information for marketing communications, please submit your request here. You may also exercise your opt-out request through physical mail at: FICO Enterprises, LLC. 6545 S. Fort Apache Rd. Suite #135-177, Las Vegas, NV, 89148.

Modifications or Amendments From time to time, we may change this Privacy Policy to accommodate new technologies, industry practices, regulatory requirements or for other purposes. We will provide notice to you if these changes are material on this Website, and where required by applicable law, we will obtain your consent. For your information, the date this Policy was last updated is listed at the top of this page. Your continued use of this Website after any such changes have been made signifies and confirms your acceptance of any changes or amendments to this Privacy Policy.

Children Under the Age of 18 This Website is not intended for children under eighteen (18) years of age. No one under 18 years of age may access or provide any information on this Website. We do not knowingly collect personal information from children under 18 years of age.

Your Rights Under the CCPA

General Information. If you are a California Resident, you are entitled to additional rights over your personal information under the California Consumer Privacy Act of 2018 (CCPA) and certain other privacy and data protection laws. This section summaries the categories of information we collect about you, why the information is collected, who we share your information with, and for what reason that information is shared.

|

A) |

Category of Information

Examples

Source of Information

Purpose of Collection

Who Do We Share With |

|

B) |

Category of Information

Examples

Source of Information

Purpose of Collection

Who Do We Share With |

|

C) |

Category of Information

Examples

Source of Information

Purpose of Collection

Who Do We Share With |

|

D) |

Category of Information

Examples

Source of Information

Purpose of Collection

Who Do We Share With |

|

E) |

Category of Information

Examples

Source of Information

Purpose of Collection

Who Do We Share With |

|

F) |

Category of Information

Examples

Source of Information

Purpose of Collection

Who Do We Share With |

|

G) |

Category of Information

Examples

Source of Information

Purpose of Collection

Who Do We Share With |

|

H) |

Category of Information

Examples

Source of Information

Purpose of Collection

Who Do We Share With |

|

I) |

Category of Information

Examples

Source of Information

Purpose of Collection

Who Do We Share With |

|

J) |

Category of Information

Examples

Source of Information

Purpose of Collection

Who Do We Share With |

Right to Know As a California resident, you have the right to know (i) the categories of personal information we collected about you in the preceding 12 months; (ii) the sources from which the personal information was collected; (iii) the business or commercial purpose for which it collected or sold the personal information; and (iv) the categories of third parties with which the business shares personal information.

Additional Privacy Rights You also have the right (i) to request that we tell you what specific information we have about you; (ii) to request that we delete your information; (iii) to opt-out of having your information sold; and (iv) for us not to discrimination against you for exercising these privacy rights. Please note that you may only make a CCPA-related request twice within a 12-month period.

Right to Non-Discrimination We will not discriminate against you for exercising any of your CCPA rights. Unless otherwise permitted by the CCPA, we will not (i) deny you goods or services; or (ii) provide you a different level or quality of good or service.

How to Submit Your Request for Specific Information You can request access to specific information we have about you by sending an email with the Subject Line “CCPA Right to Know” to info@reliablecreditscore.com In your request, please provide us with enough information to identify you, including (i) your full name; (ii) physical address; (iii) phone number; (iv) email address; (v) proof of your identity (e.g. driver’s license or passport); and (vi) a description of what right you want to exercise. Once your request is submitted, we will reach out to you within the timeframe required by law to verify your identity. After we verify your identity, we will send your information to you via an electronic format. Any personal information we collect from you to verify your identity in connection with your request will be used solely for the purposes of verification.

How to Exercise Your Right to Delete Information You can request the categories of information we have on file or deletion of information available on our request form available at here. You may also submit this request by sending an email with the Subject Line “CCPA Right to Request or Delete Information” to info@reliablecreditscore.com. In your request, please provide us with enough information to identify you, including (i) your full name; (ii) physical address; (iii) phone number; (iv) email address; (v) proof of your identity (e.g. driver’s license or passport); and (vi) a description of what right you want to exercise. Once your request is submitted, we will reach out to you within the timeframe required by law to verify your identity. After we verify your identity, we will send your information to you via an electronic format. Any personal information we collect from you to verify your identity in connection with your request will be used solely for the purposes of verification.

How to Exercise Your Right to Opt-Out of Sale of Your Information Under the CCPA, if you are 16 years of age or older, you have the right to direct us not to sell your personal information at any time. You may submit your request through the URL provided below. You may also submit this request by sending an email with the Subject Line “CCPA Do Not Sell My Information” to info@reliablecreditscore.com. In your request, please provide us with enough information to identify you, including (i) your full name; (ii) physical address; (iii) phone number; (iv) email address; (v) proof of your identity (e.g. driver’s license or passport); and (vi) a description of what right you want to exercise. Once your request is submitted, we will reach out to you within the timeframe required by law to verify your identity. After we verify your identity, we will send your information to you via an electronic format. Any personal information we collect from you to verify your identity in connection with your request will be used solely for the purposes of verification.

DO NOT SELL MY PERSONAL INFORMATION

However, if you opt-out, please note that we will be unable to help you find a loan or other product or services that may be of interest to you through our Network Partners. In order to opt-in, please submit the completed form or resubmit your request, which lets us know that you want to sell your information to deliver the products and services you requested.

California Disclosures California Law requires us to provide certain disclosures to users of this Website.

Shine the Light Disclosure. Civil Code Section 1798.83 permits California residents that use this Website to request certain information regarding our disclosure of personal information to third parties for their direct marketing purposes. To make such a request, please contact us at info@reliablecreditscore.com. Please note that this section does not prohibit disclosure made for non-marketing purposes.

Do Not Track Disclosures. Business and Professions Code Section 22575(b) requires websites to disclose their practices with respect to the use of tracking technology made by third parties and whether this Website honors web browser do-not-track signals. No third parties are able to collect personally identifiable information you provide on this Website. At this time, FICO Enterprises does not respond to do-not-track browser settings or signals.

Contact Us If you have any questions or comments regarding this Privacy Policy or our practices, please reach out to us at info@reliablecreditscore.com